The Best Guide To What Is a Tax Accountant? - TurboTax Tax Tips & Videos - Intuit

Mostly, the IRC (Internal Income Guide) governs the concerns of accounting tax by setting out standards and guidelines on how tax returns are to be prepared by individuals and business. In basic terms, tax accounting is essentially accounting with an aim of fulfilling the requirements of local and national tax law and expectation.

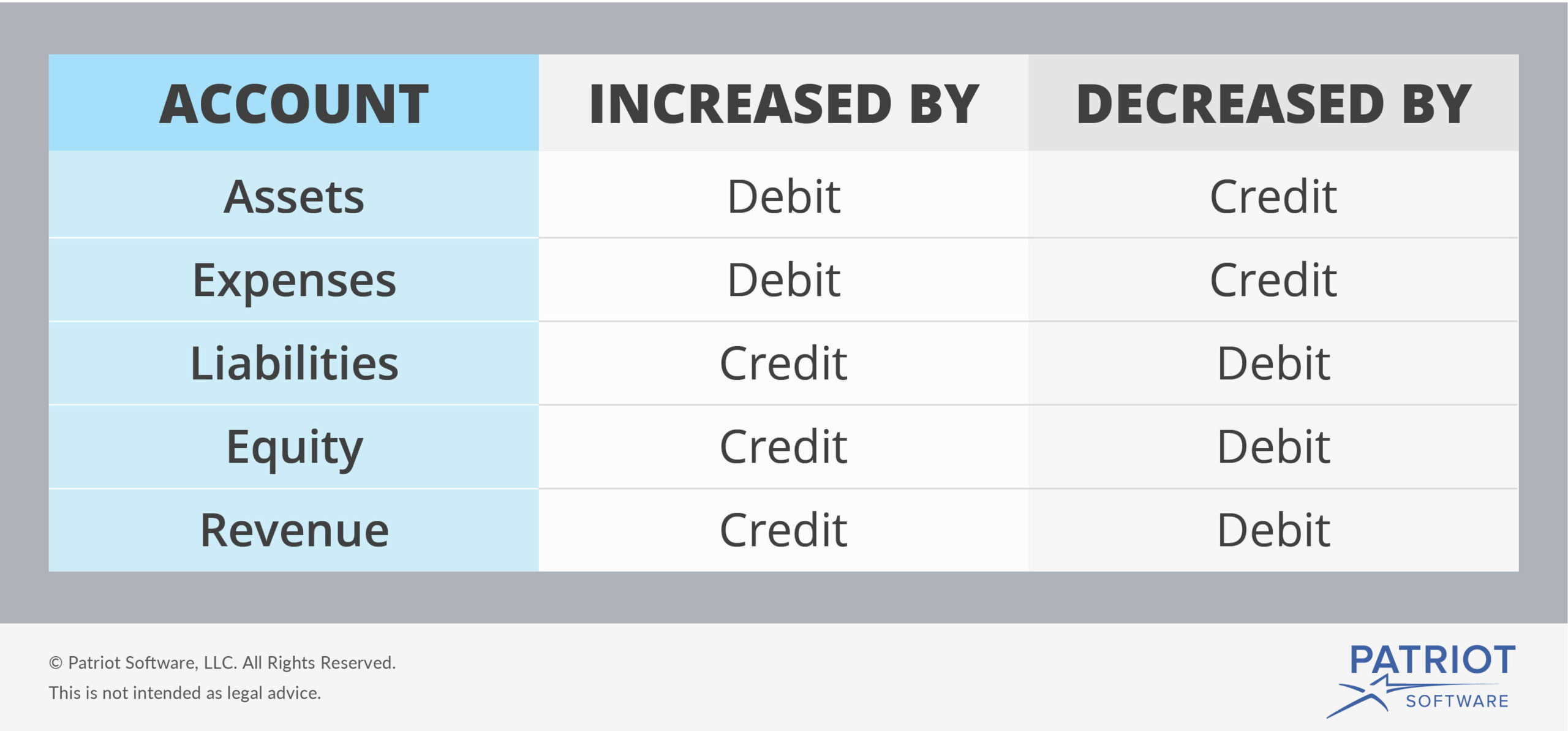

Tax accounting is vital in the tracking of funds associated to business entities and individuals. Generally accepted accounting concepts (GAAP) hold that business are anticipated to stick to set standards, procedures and concepts in the procedure of assembling financial declarations through making sure all monetary deals are represented. Accounting tax treatments might involve whole financial transactions, but it's mainly geared towards any deal with an effect or impact on the tax concern of an organization or individual.

Products on balance sheets can easily be accounted in another way in the preparation of tax payables and minding monetary statements. This is seen when business end up preparing monetary statements through FIFO (First-In-First-Out) technique execution in the recording of financial related stock, and LIFO (Last-In-First-Out) method for the taxes.

Accounting in its entirety is focused entirely on monetary transactions while accounting tax is extremely biased towards specific financial deals impacting the tax problem of a specific or company and the way each of the transactions associate with the preparation of tax documents and computation of taxes. In Find Out More Here United States, IRS (Irs) regulates tax accounting and makes sure all associated tax standards and laws are followed to the letter by taxpayers and specialists dealing with tax accounting.

An Unbiased View of Professional Tax & Accounting Services, LLC- Facebook

It deserves noting that the United States, unlike other nations, has a really extensive accounting tax principles (tax law prescribed) and mostly dissimilar and removed from the standards under GAAP. Accounting tax whether accounting for income taxes or other might result in gross incomes largely unique from what's reported by an organization or person's statement of earnings.

The differences are not permanent thinking about settlement of liabilities will be done and possessions recovery completed ending the differences. Tax and accounting services are dealt with by those accounting professionals who have actually chosen to focus on tax on its entirety. Tax accounting professionals deal with corporations or specific individuals to deal with audits, financial records and reports and general tax